10 best adams vehicle mileage book afr10w for 2022

We spent many hours on research and managed to find top 10 adams vehicle mileage book afr10w that is best suitable for you. This review is based on reliable sources, product specs, and hundreds of customer reviews. In this article, were going to highlight the main features of the best adams vehicle mileage book afr10w and why they are important when it comes to choosing the right one.

Best adams vehicle mileage book afr10w

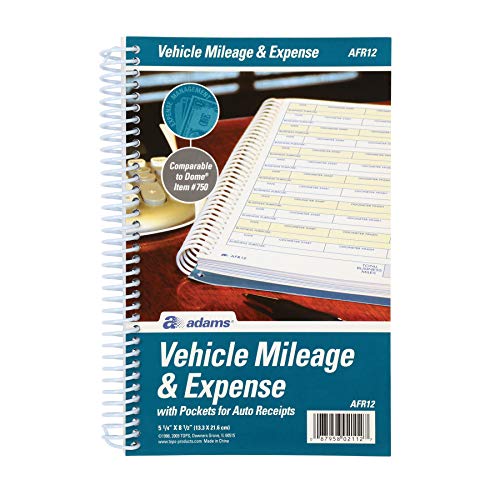

1. Adams ABFAFR12 Vehicle Mileage and Expense Journal, 5-1/4" x 8-1/2", Fits the Glove Box, Spiral Bound, 588 Mileage Entries, 6 Receipt Pockets,White

Feature

KEEP PERFECT RECORDS: Adams Vehicle Mileage and Expense Journals help you log business use of your car or truck with year start and year end odometer readings and flawless daily recordsGET THE BEST DEDUCTION: 588 entries capture the date, odometer readings, total miles and business purpose-everything you need to document business use for the IRS

SUMMARIES MAKE TAX TIME EASY: Annual summary pages hold monthly mile totals to calculate percentage of business use; monthly maintenance totals help you deduct unreimbursed vehicle expenses

INCLUDES 6 RECEIPT POCKETS: Don't forget to save receipts; you get 2 double-sided pockets for oil changes and other service; 2 pockets for repairs, and 2 pockets for parking and tolls

KEEP IT IN THE CAR: This portable 5-1/4 x 8-1/4 booklet was meant to travel with you; keep one in each glove compartment for a complete record of business use

Description

Adams Vehicle Mileage and Expense Journals help you keep detailed daily records on the use of your car for business. You get 588 entries to capture the date, odometer start and finish, total business miles and business purpose for each trip. An annual summary page holds monthly totals to calculate business use percentage. Get 6 pages to record maintenance and repairs, a page for annual totals, and 4 pages for parking and tolls. Includes 6 handy pockets for receipts. Small & portable enough to fit the glove box with a heavy cardstock cover that can survive life in your car. An indispensable help for tax season!Vehicle Mileage and Expense Journal. 5-1/4" x 8-1/2" inches.

Maximize your deduction: Don't leave one of your largest deductible business expenses to an imperfect memory. Adams Vehicle Mileage and Expense Journals makes it easy to document your standard mileage deduction for the IRS.

588 Mileage Logs: You get 49 pages of entries. Record odometer starts and stops, trip mileage, dates, and place for each business use. More than enough entries for a typical year.

Quick-calculate business use: An annual summary page in back provides slots for monthly totals. Gives you the equation to calculate how much your car was used for businessa.k.a. your business-use percentagefor tax time.

Extras in back: Get 6 pages to log maintenance and repairs and 4 to track parking and tolls. Includes 2 pockets each for service, repair, and parking & toll receipts. More deductible expenses!

Fits the glove compartment: Keep it with you always. Your meticulous records will make tax time a breeze.

Ideal for small businesses: Keep one in every car so no expense goes untracked.

2. Adams AFR10W Vehicle Mileage Log

Feature

Record Daily Vehicle Mileage, Maintenance, Repairs, Parking and Tolls for Business and Personal UseRecord Expenses for up to Four Vehicles

Documents IRS Required Information

Includes a Section to Summarize Annual Mileage and Maintenance.

Perfect for Glove Compartment Storage

Description

Keep track of your vehicle mileage and trip purpose for business or personal use. Includes a summary for tax filing.3. Adams Vehicle Mileage Journal, , 3.25 x 6.25 Inches, White (AFR10)

Feature

Track your monthly business or personal vehicle mileage31 entries per month ensure all trips can be recorded

Includes year-end summary and space for other expenses incurred

3.25 x 6.25 inches

Easy to use

Description

Adams Business Forms provide the tools to help keep track of messages, finances, transactions, employees, taxes, and customers to businesses throughout the world. These products are the perfect way to create and maintain a professional image for small businesses and service providers. Adams Vehicle Mileage Journals track your monthly business or personal vehicle mileage. This easy-to-read vehicle mileage log features 31 entries per month to ensure all trips can be recorded. Each Mileage Journal includes a year-end summary as well as space for other expenses incurred. These forms were designed with everyone from the corporate business traveler to the small business/home business owner in mind. Whether it's a multi-part form, notebooks, writing pads, record books, or any of the hundreds of items we offer, you can count on Adams products to help!4. Adams Vehicle Expense Journal, , 3.25 x 6.25 Inches, White (AFR11)

Feature

All you need to track your expensesEntry fields for miles driven, gasoline, oil changes, parking and tolls, repairs, washes and more

Two page layout allows you to track expenses by day for 12 months

Monthly and annual summary pages in the back for accurate record keeping

Great for corporate business travelers and small business/home business owners

Description

Adams Business Forms provide the tools to help keep track of messages, finances, transactions, employees, taxes, and customers to businesses throughout the world. These products are the perfect way to create and maintain a professional image for small businesses and service providers. Adams Vehicle Expense Journals track your monthly business or personal vehicle expenses. This easy-to-read vehicle expense log features entry fields for miles driven, gasoline, oil changes, parking and tolls, repairs, washes and more. A specially designed two page layout allows you to track expenses by day for up to 12 months. Monthly and annual summary pages are located in the back for accurate record keeping. These forms were designed with everyone from the corporate business traveler to the small business/home business owner in mind. Whether it's a multi-part form, notebooks, writing pads, record books, or any of the hundreds of items we offer, you can count on Adams products to help!5. Dome(R) Auto Mileage Log, Card Stock Cover, 3 1/4in. x 6 1/4in., Gray

Feature

Auto Mileage Log helps you keep track of how you use your automobile for business purposes. Record miles, parking and tolls on 12 monthly forms.Log contains 32 pages, a detachable year-end summary, required affidavit for tax preparer and space for essential automobile data.

Undated log can start any time and is good for a full year.

6. Dome Auto Mileage Log, Undated, 32 Forms [Set of 3]

7. Auto Mileage & Expense Notebook Vehicle Mileage Log, Miles Log Book to Track Over 400 Rides or Sessions, Track Odometer for Business Driving or Rideshare Apps 5 x 8 Inches, 60 Pages (Pack of 1)

Feature

TRACK MILEAGE AND MORE: Tracking mileage and expenses for work doesnt have to be a time-consuming chore. With the Portage mileage notebook, keeping track of business expenses is easy.EXTRA PAGES: Meant to last the whole year, the Portage mileage log includes 60 pages, 33% more pages than other top brands. This mileage notebook measures 5 x 8, making it large enough to comfortably fill out while being small enough to fit in a glove compartment, center console or work bag.

SIMPLE FORMAT: Each page is designed with spaces for the date, business purpose, odometer reading, and total mileage. Plus, our form boxes give you plenty of space to write comfortably.

DURABLE DESIGN: Built to last, our spiral mileage logbook is constructed with extra-thick paper and a stiff backing meant to stand up to daily use.

RECORD ON YOUR TERMS: Whether you need to track actual expenses or just mileage for a flat deduction rate, this journal has you covered.

8. Adams Vehicle Expense Journal, 3.25 x 6.25 Inches, White (AFR11), 3 Pack

Feature

All you need to track your expensesEntry fields for miles driven, gasoline, oil changes, parking and tolls, repairs, washes and more

Two page layout allows you to track expenses by day for 12 months

Sold as 3 PACK

Monthly and annual summary pages in the back for accurate record keeping

9. Adams AFR10W Mileage Journal (1)

Feature

Keep precise record of your daily mileage in a thorough, compact log bookIncludes fields for the date, destination, and odometer begin and end for each trip

Provides monthly and annual summary pages for tax time and a log for service and parts

Convenient 3-1/4" x 6-1/4" size travels well and fits the glove compartment

Soothing blue interior ink color helps keep eyes from getting tired

10. Synology DiskStation DS1019+ iSCSI NAS Server with Intel Celeron Up to 2.3GHz CPU, 8GB Memory, 10TB HDD Storage, DSM Operating System

Feature

Synology DiskStation DS1019+, made for a variety of server roles such as iSCSI targets backup, file storage, email servers, and domain controllers!Intel Celeron J3455 Quad-Core 1.5GHz 2MB CPU, Turbo Up To 2.3GHz; 8GB DDR3L Synology SDRAM Memory; 10TB (5 x 2TB) 7.2K 6Gb/s SATA 3.5" HDDs for High Capacity Storage; 2 x RJ-45 1GbE LAN Port (with Link Aggregation / Failover support); 2 x USB 3.0 Port; 1 x eSATA Port, Btrf File System for Advanced LUN iSCSI Service

Operating System: Synology DSM Software

Synology NAS chassis comes in a sealed box.

Hard drives and memory upgrades included separately NOT installed, installation required.

![Dome Auto Mileage Log, Undated, 32 Forms [Set of 3]](https://m.media-amazon.com/images/I/41sEwjitquL._SL500_.jpg)

Recent Comments